The “Kakeibo” Way of Saving Money

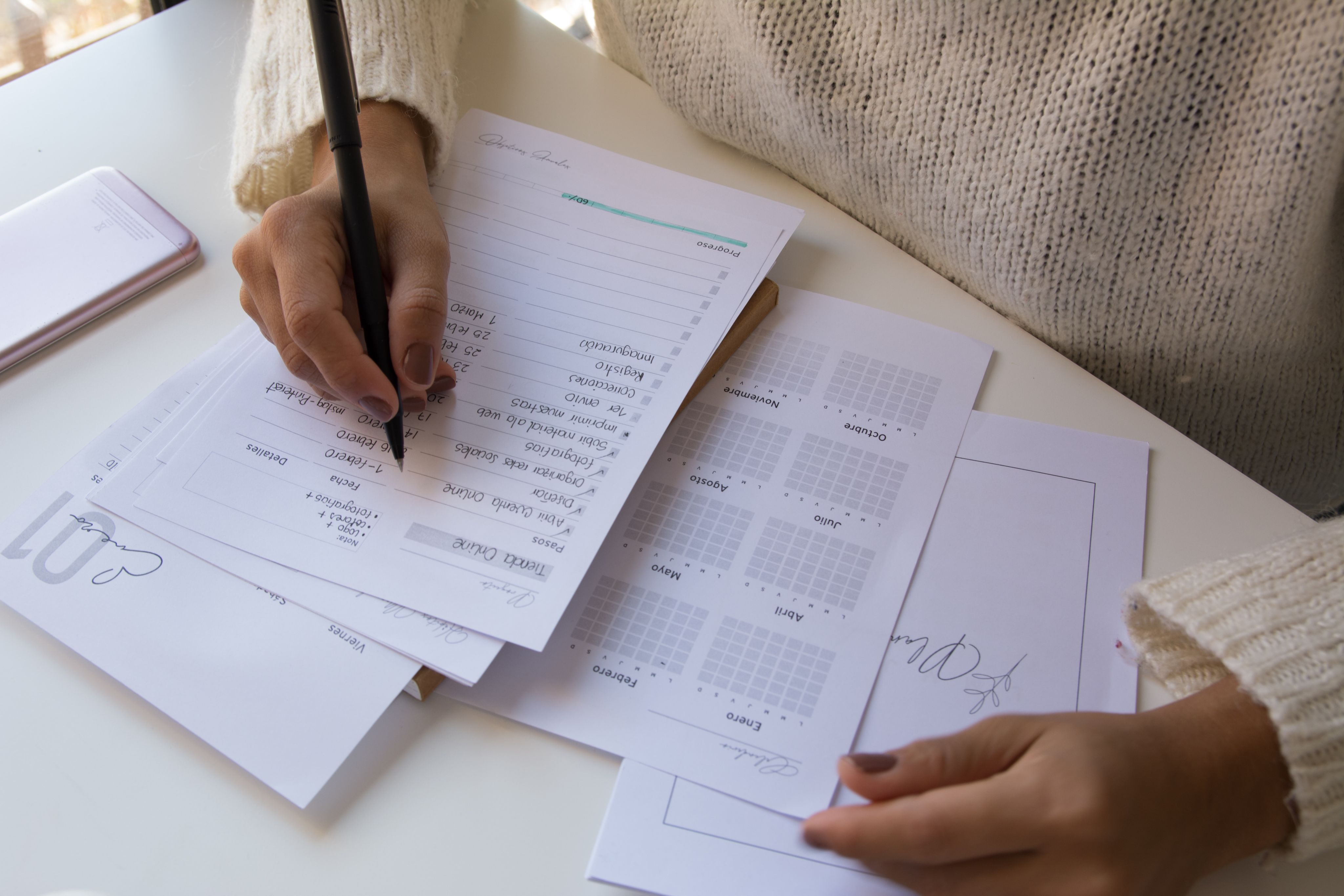

Remember the good ol’ days of planning your monthly budget by jotting down your income and expenses in a humble notebook? This old school way of financial management free from budgeting apps is popular not only in Japan but around the world and its called “Kakeibo” (pronounced “kah-keh-boh”).

Here’s what you need to know about kakeibo to become financially savvy.

What is “Kakeibo”?

It is a Japanese word for “household account book”. The concept was created by Hani Makoto, the first female journalist in Japan. Her magazines were targeted at a housewife audience in which she encouraged her readers to devise schedules and systems for household tasks including managing finances of the household.

How Kakeibo Can Work for You

All you need is a pen and paper or a notebook. Take a moment to answer these 4 important questions:

This method is a multi-step process which may be done at the beginning of a new year or month and even at the end of the month for the purposes of reviewing your spending and finances.

Based on the questions above, you can now proceed to plan your finances.

1) Conduct A General Review

Identify your income and expenses for the year. Make a note of those expenses that occur daily or monthly such as meal and transport expenses as well as those that may only be incurred once in a year such as going on a vacation or renewal of car insurance.

2) Devise A Monthly Spending Plan

Determine your total income on a monthly basis including your salary and other side-hustle income and how much you will be spending by recording your fixed expenses such as rent, utility bills, health insurance, and debt payments. To answer the first question ie “How much income and savings do you have available?“, subtract your fixed expenses from your income.

3) Calculate The Amount Available for Weekly Spending

To determine the total amount available for weekly spending, subtract your savings goal from the amount you have available and divide the balance with the number of weeks in a month and the final amount is the total amount available for your weekly spending.

Keep track of your weekly spending by dividing them into categories as follows:

Source: Goodbudget

Survival expenses are basically fixed expenses such as rent, food and transport expenses. Optional expenses include occasional expenditure such as shopping and dinner trips or outings with friends. Culture expenses include spending on books, music, shows, movies, magazines and Extra expenses include one-off expenses such as wedding gifts or emergency medical expenses and even repairs to your car.

4) Analysis Your Monthly Spending Habits

Once you are able to see where your money is going to and spending habits, you are now ready to answer the question ” how to improve” by reducing your expenditure. In doing so, asking yourself whether you have spent too much in some categories can help you reach your target for savings.

Make notes on expenses you can cut down and other reminders for reference purposes – it will come in handy when you are managing finances for the following month!

The Kakeibo method is a simple and effective way to pay more attention to your expenses by assessing your spending habits and plan for the future!